7 Simple Techniques For Best Broker For Forex Trading

7 Simple Techniques For Best Broker For Forex Trading

Blog Article

Our Best Broker For Forex Trading PDFs

Table of ContentsThe smart Trick of Best Broker For Forex Trading That Nobody is DiscussingIndicators on Best Broker For Forex Trading You Need To KnowThe Greatest Guide To Best Broker For Forex TradingThe 8-Minute Rule for Best Broker For Forex TradingThe Ultimate Guide To Best Broker For Forex Trading

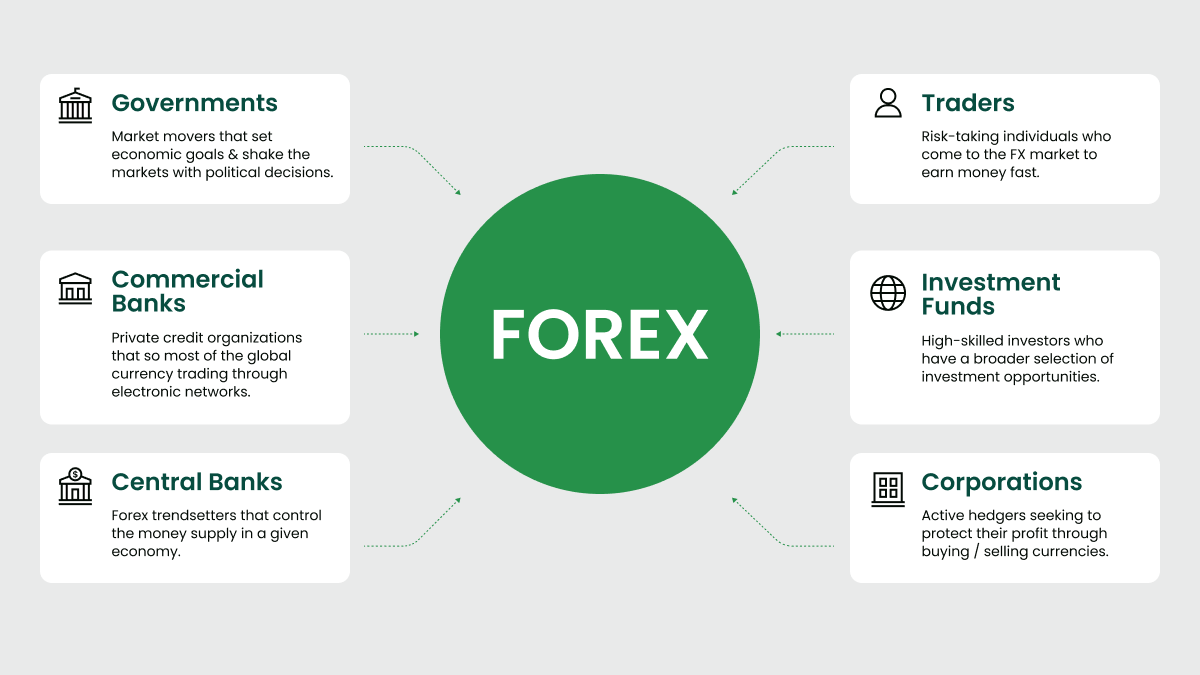

One money set a person might desire to profession is the EUR/USD. If this particular pair is trading for 1.15 pips, and they assume the exchange price will increase in worth, they can buy 100,000 euros worth of this money pair - Best Broker For Forex Trading.Usually, forex markets are shut on weekends, yet it's possible some capitalists still trade throughout off-hours. With the OTC market, purchases can take place whenever 2 parties are ready to trade.

In finding out forex trading techniques for newbies, numerous retail capitalists obtain attracted in by the very easy accessibility to leverage without recognizing all the nuances of the marketplace, and leverage might amplify their losses. For those who determine to engage in foreign exchange trading, there are numerous various strategies to pick from.

Generally, forex trading methods, like other types of investing, usually fall under one of two camps: technical analysis or basic analysis (Best Broker For Forex Trading). In addition to essential evaluation vs. technical analysis, forex trading can likewise be based upon time-related trades. These may still be based upon basic or technological analysis, or they may be extra speculative gambles in the hopes of making a quick profit, without much analysis

The Basic Principles Of Best Broker For Forex Trading

Some time-based trading techniques consist of: Day trading includes purchasing and selling the same setting within the exact same day. If you day trade the EUR/USD pair, you could initially get the position at a rate of 1.10 and market it later that day for 1.101 for a small gain.

For instance, a trader may observe that there's been recent momentum in the euro's toughness vs. the united state buck, so they could get the EU/USD pair, in the hopes that in a week or so they can cost a gain, before the energy fizzles. Placement trading normally implies long-term investing, instead of temporary conjecture like with day trading, scalping, or swing trading.

Best Broker For Forex Trading Fundamentals Explained

dollars, causing the cost of USD to acquire vs. JPY. Also if there's no evident underlying financial reason the U.S. economic climate need to be checked out extra favorably than the Japanese economic situation, a technical evaluation could determine that when the USD gains, claim, 2% in one week, it has a tendency to enhance an additional 2% the following week based on energy, with capitalists loading onto the trade for anxiety of losing out.

As opposed to technical evaluation that bases forecasts on past rate movements, fundamental evaluation looks at the underlying economic/financial reasons why a property's cost might alter. If that happens, after that the USD might obtain stamina versus the euro, so a forex capitalist utilizing basic analysis could try to obtain on the ideal side of that profession. If U.S. passion rates are anticipated to fall faster than the EU's, Website that can create capitalists to favor acquiring bonds in the EU, consequently driving up demand for the euro and damaging demand for the dollar.

Again, these are just hypotheticals, however the factor is that fundamental analysis bases trading on underlying variables that drive prices, besides trading task. Best Broker For Forex Trading. Along with figuring out the right foreign exchange trading approach, it's essential to select a strong foreign exchange broker. That's since brokers can have various rates, such as the spread they bill in between buy and sell orders, which can cut into prospective gains

While foreign exchange trading is usually much less strictly regulated than stock trading, you still intend to select a broker that follows appropriate guidelines. For instance, in the united state, you might look for a broker that's regulated by the Commodity Futures Trading Compensation (CFTC) and the National Futures Association (NFA). You also intend to review a broker's safety and security methods to make sure that your money is risk-free, such as checking whether the broker segregates customer funds from their very own and holds them at managed financial institutions.

Best Broker For Forex Trading - Truths

This can be subjective, so you may intend to seek a broker that offers trial accounts where you can obtain a feeling of what trading on that particular platform resembles. Different brokers might have different account types, such as with some geared extra towards newbie retail investors, and others toward more expert investors.

Yes, foreign exchange trading can be great site dangerous, especially for specific financiers. Banks and other institutional financiers frequently have an informational advantage over retail financiers, which can make it harder for people to profit from forex trades.

Report this page